When it comes to purchasing goods, hidden costs like shipping and duties often catch people off guard. It’s crucial to understand how to estimate the total cost accurately.

To estimate your total purchase cost, include product price, shipping fees, and duties. Each factor varies by region and supplier.

Understanding these costs upfront will help you plan better and avoid unpleasant surprises.

How do you calculate total purchase cost?

Calculating the total purchase cost is the first step to understanding your overall expenses. It includes the product price and any additional fees from your supplier.

The total purchase cost equals the product price plus any additional supplier fees, such as handling or packaging charges.

Understanding supplier fees1 is vital. For example, some suppliers include packaging costs, while others list them separately. Always request a detailed invoice to verify the breakdown2.

Breaking Down Purchase Cost

| Component | Example Fee | Explanation |

|---|---|---|

| Product Price | $1,000 | The cost of the items purchased. |

| Supplier Fees | $50 | Includes handling or special packaging. |

| Discounts/Rebates | -$100 | Deducted promotional or bulk purchase rebates. |

How do you calculate total shipping cost?

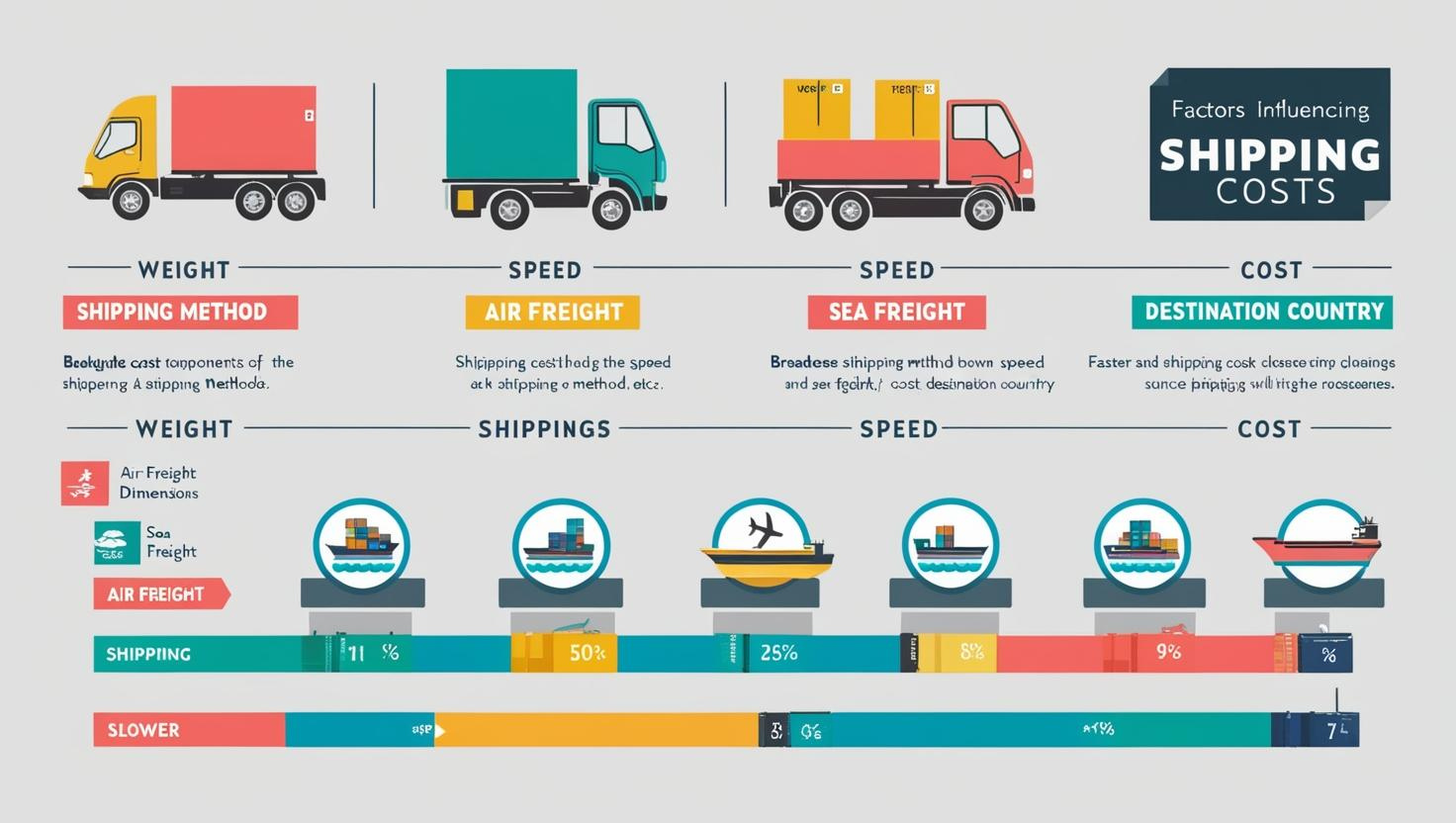

Shipping costs depend on the chosen method, delivery speed, and destination.

To calculate shipping cost, consider the product’s weight, dimensions, shipping method, and destination country.

Some shipping methods, like air freight3, are costlier but faster. For instance, air freight might be twice as expensive as sea freight but delivers in a fraction of the time.

Factors Affecting Shipping Costs

- Weight and Dimensions: Heavier or larger items cost more to ship.

- Shipping Method: Air freight is faster but more expensive than sea freight.

- Destination Fees: Remote areas often incur higher charges.

Example Calculation

If a package weighs 10kg and is shipped via air to the U.S., the cost might include:

- Base fee: $5 per kg.

- Additional handling: $10.

- Total: $60.

How to calculate duty cost?

Duties depend on the product type and destination country’s regulations.

Duty cost is calculated as a percentage of the product’s value, based on the Harmonized System (HS) code4.

Understanding HS codes is critical as they determine the duty percentage. For example, cosmetics might have a duty rate of 5%, while electronics could be 15%. Consult your customs broker5 for accurate rates.

Key Factors in Duty Calculations

- HS Code: Determines the duty rate.

- Customs Value: Includes product price and shipping cost.

- Destination Rules: Some countries offer exemptions for low-value imports.

| Duty Example | Value ($) | Duty Rate | Total Duty ($) |

|---|---|---|---|

| Product Value | $1,000 | 10% | $100 |

| Shipping Cost | $100 | ||

| Duty Base | $1,100 | $110 |

What is the formula for total landed cost?

The landed cost includes every expense from product price to delivery. It helps you understand the true cost of your purchase.

Landed cost = Product price + Shipping cost + Duties + Additional fees (e.g., insurance).

This formula ensures transparency. By calculating all components, you can make better financial decisions and assess profitability6.

Total Landed Cost Example

Let’s calculate for a $1,000 product with:

- Shipping: $100

- Duties: $110

- Insurance: $20

Total landed cost = $1,000 + $100 + $110 + $20 = $1,230

What is the difference between FOB cost and landed cost?

Understanding FOB and landed costs is essential for comparing supplier quotes.

FOB7 (Free On Board) cost covers product price and transport to the shipping port, while landed cost includes all costs up to delivery.

Suppliers often quote FOB, leaving you to estimate shipping and duties. Landed cost provides a complete view, making it ideal for budget planning8.

Comparison Table

| Cost Type | Includes | Example Value |

|---|---|---|

| FOB Cost | Product price + Port transport | $1,050 |

| Landed Cost | FOB + Shipping + Duties + Insurance | $1,230 |

Conclusion

To estimate the total cost of your purchase, calculate the product price, shipping, and duties. Consider landed costs for a full financial picture.

-

Explanation of supplier fees in product cost calculations. ↩

-

Importance of requesting detailed supplier invoices. ↩

-

Comparison of air freight and sea freight costs. ↩

-

Overview of Harmonized System (HS) codes and their role in duty calculation. ↩

-

Importance of consulting a customs broker for accurate duty rates. ↩

-

Formula and breakdown of components in landed cost calculations. ↩

-

Definition of FOB (Free On Board) and its implications. ↩

-

Comparison of FOB cost and landed cost for budgeting. ↩