Consolidating multiple product types into a single large order often sparks curiosity. Is it a cost-effective approach? How does it impact logistics and pricing?

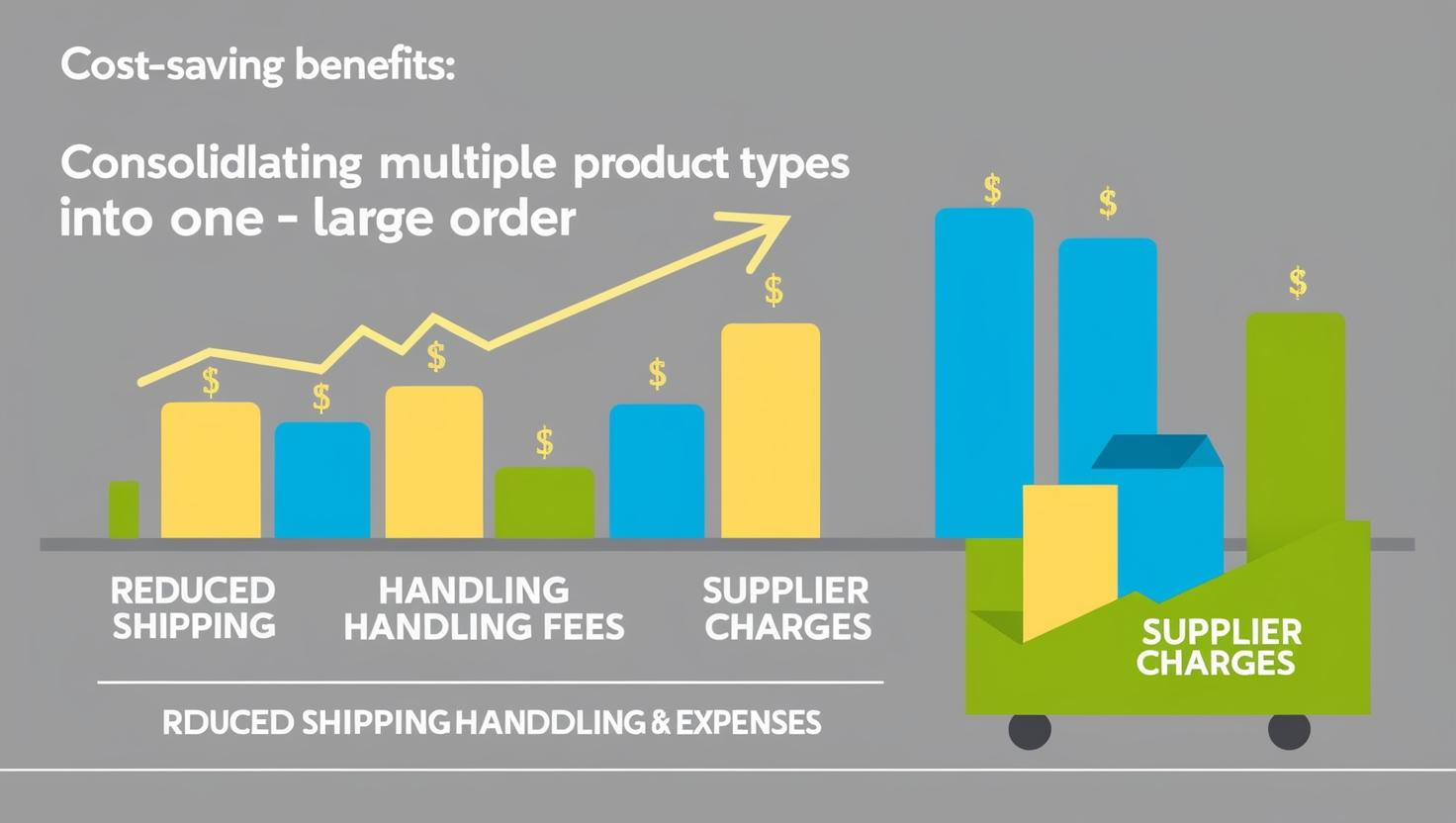

Yes, consolidating multiple product types into one large order can reduce costs by minimizing shipping expenses, handling fees, and supplier charges cost-saving benefits1.

Let’s explore the mechanics of consolidation and how it leads to cost savings.

Is It Cheaper to Consolidate Packages?

Does consolidating packages reduce overall expenses? Let’s take a closer look at why this strategy works.

Consolidating packages is cheaper because it reduces shipping fees, handling costs, and packaging expenses package consolidation benefits2.

Benefits of Consolidation

- Reduced shipping costs: Combining items into fewer shipments lowers transportation expenses.

- Fewer handling charges: Minimizing separate packages decreases logistical overhead handling fee reduction3.

- Eco-friendly savings: Consolidating packages reduces waste and carbon footprints.

Understanding these benefits allows businesses and individuals to optimize logistics and save money.

What Is the Purpose of Consolidation Merging?

Why do companies or supply chains consolidate processes and shipments?

The purpose of consolidation merging is to streamline operations, lower costs, and improve efficiency consolidation purpose4.

Practical Uses of Consolidation Merging

- Supply chain management: Merging shipments reduces bottlenecks and simplifies tracking.

- Warehouse optimization: Consolidation maximizes storage space and reduces inventory costs.

- Financial efficiency: Combining transactions lowers administrative and processing fees.

These advantages demonstrate how consolidation merging fosters smoother operations and cost-effectiveness.

What Does Consolidating Implies Reducing Multiple Accounts Mean?

When businesses consolidate multiple accounts, what does this entail, and how does it save money?

Consolidating multiple accounts involves merging resources or operations to reduce redundancies and cut costs account consolidation benefits5.

Benefits of Account Consolidation

- Lower administrative costs: Managing fewer accounts reduces paperwork and processing fees.

- Streamlined operations: Centralized accounts simplify workflows and enhance decision-making.

- Cost savings: Consolidation eliminates duplicate services, saving time and money.

This strategy is particularly useful for businesses aiming to simplify their operations.

What Happens When Two Companies Consolidate?

What are the financial and operational outcomes of company consolidation?

When two companies consolidate, they combine resources, reduce overhead costs, and often improve market competitiveness company consolidation outcomes6.

Key Impacts of Company Consolidation

- Operational synergy: Consolidation eliminates redundancies and leverages shared expertise.

- Economies of scale: Larger combined operations lead to cost savings and improved efficiency.

- Market expansion: Unified companies can access broader customer bases and stronger market positions.

Company consolidation is a powerful tool for achieving growth and long-term stability.

Conclusion

Consolidating multiple product types, processes, or accounts can lead to significant cost savings by reducing logistical, operational, and administrative expenses. Whether you’re a business owner or a consumer, understanding the value of consolidation can help you make smarter decisions.

-

Cost-saving benefits explain how consolidating orders reduces expenses for businesses and individuals. ↩

-

Package consolidation benefits demonstrate how fewer shipments lead to reduced shipping and handling costs. ↩

-

Handling fee reduction shows how combining packages minimizes logistical expenses. ↩

-

Consolidation purpose explains why merging shipments and operations improves efficiency and lowers costs. ↩

-

Account consolidation benefits outline how reducing multiple accounts eliminates redundancies and streamlines operations. ↩

-

Company consolidation outcomes reveal how merging companies improves competitiveness and financial stability. ↩